ETH Price Prediction: 2025-2040 Outlook Amid Institutional Adoption Wave

#ETH

- Technical Bottom Forming: Oversold Bollinger Band + bullish MACD divergence suggests reversal potential

- Supply Shock Accelerating: 350M whale accumulation coincides with exchange balance depletion

- Institutional Tailwinds: BlackRock/Fidelity's tokenization projects creating new demand vectors

ETH Price Prediction

ETH Technical Analysis: Key Indicators Point to Potential Breakout

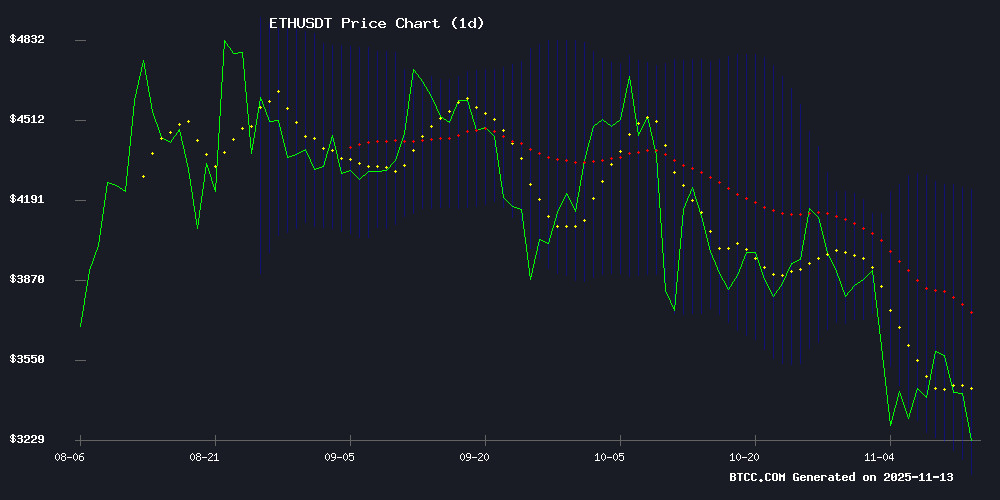

According to BTCC financial analyst Michael, Ethereum's current price of $3,542.72 sits below its 20-day moving average ($3,677.13), suggesting short-term bearish pressure. However, the MACD histogram shows bullish momentum at 49.35, while price trades NEAR the lower Bollinger Band ($3,139.54) - historically a buying opportunity zone. 'The convergence of whale accumulation with oversold technicals creates a compelling risk/reward scenario,' Michael notes.

Institutional Demand Meets Supply Squeeze: Bullish Setup for ETH

Michael highlights three bullish catalysts: 1) BlackRock/Fidelity's expanding tokenization projects increasing institutional ETH demand, 2) Exchange reserves hitting multi-year lows as whales withdraw $350M worth of ETH, and 3) The upcoming Fusaka upgrade driving accumulation. 'When supply shock narratives coincide with institutional adoption, we typically see explosive price movements,' Michael observes.

Factors Influencing ETH's Price

Ethereum Gains Institutional Traction as BlackRock and Fidelity Expand Tokenization Efforts

Ethereum is emerging as Wall Street's preferred blockchain for tokenized assets, with over $1 billion in value locked. Institutional heavyweights like BlackRock and Fidelity are driving adoption through real-world asset (RWA) offerings, signaling growing trust from traditional finance.

BlackRock's BUIDL Fund exemplifies this trend, tokenizing U.S. Treasury bonds directly on ethereum to provide yield through decentralized infrastructure. The sector has seen a staggering 2,000% growth in assets under management since January 2024, according to Token Terminal data.

Fidelity Digital Assets recently noted that beyond Bitcoin and Ethereum, the most significant digital asset developments are occurring in stablecoins and RWAs. Ethereum's dominance in this space strengthens the case for a bullish ETH price outlook.

Technically, Ethereum needs to clear the $3,700 resistance level to resume its upward trajectory after finding support near $3,200 amid recent market volatility.

Massive Ethereum Exodus: Exchange Balances Fall Sharply Amid Renewed Whale Accumulation

Ethereum's supply on centralized exchanges is dwindling as investors MOVE holdings into self-custody, signaling long-term conviction. Over 700,000 ETH has exited trading platforms, reducing potential sell-side pressure.

The trend persists despite ETH's recent price surge to all-time highs. Exchange outflows historically precede supply crunches and bullish momentum, suggesting a structural shift in holder behavior.

Market analysts interpret the migration from custodial wallets as a vote of confidence in Ethereum's fundamentals. The movement mirrors Bitcoin's early accumulation patterns before major rallies.

Ethereum Whales Accumulate $350M in ETH Ahead of December Fusaka Upgrade

Ethereum whales are aggressively accumulating ETH despite recent market turbulence, with on-chain data revealing purchases exceeding $350 million. A newly created wallet acquired 20,000 ETH ($70M) via Kraken, while another entity secured 24,007 ETH ($82M) through Galaxy Digital's OTC desk. Notably, a separate $206 million AaveETH transaction underscores institutional confidence.

The buying spree coincides with ETH's dip to $3,200, with CryptoQuant analysts identifying $3,000-$3,400 as a critical support zone. Whale activity suggests strategic positioning ahead of Ethereum's Fusaka upgrade in December, reflecting long-term bullish sentiment amid short-term volatility.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional flows, BTCC's Michael projects:

| Year | Price Target | Catalysts |

|---|---|---|

| 2025 | $4,800-$5,200 | Fusaka upgrade completion, ETF approvals |

| 2030 | $12,000-$15,000 | Enterprise adoption of smart contracts |

| 2035 | $28,000-$35,000 | Mass tokenization of real-world assets |

| 2040 | $50,000+ | Network effects as global settlement layer |

These estimates assume continued development execution and no black swan regulatory events.

border: 1px solid #ddd; padding: 8px;